Le financement participatif, auquel on ne pourrait plus déroger si on veut sortir du circuit bancaire traditionnel, irait-il contre le principe capitaliste, ou n’en serait-il que le nouvel avatar? Ces plateformes qui se contentent le plus souvent de mettre en relation l’offre et la demande (du type Uber ou Airbnb), ne proposant rien si ce n’est l’interface et un « coaching », se servant gracieusement au passage, permettraient-elles véritablement de financer d’autres types de projets, « hors-système »?

C’est en 2010 que Ombline le Lasseur lance KissKissBankBank, avec son mari Vincent Ricordeau et son cousin Adrien Aumont. Vincent Ricordeau, co-fondateur de la plateforme, a fondé et dirigé plusieurs entreprises avant de rejoindre SportFive, leader du marketing sportif et d’en devenir le vice-président. Il est de ceux que l’on appelle aujourd’hui les « serial entrepreneur », soit, les mêmes qu’avant mais en plus cool, décontract’, jeans et baskets.

Au départ, KissKissBankBank s’adresse aux musiciens et leur permet de solliciter les internautes afin de mener à bien leurs projets, mais s’élargira très vite à d’autres domaines. Mais pour rassurer l’industrie musicale et lever les fonds, la fondatrice doit trouver les mots afin qu’ils comprennent que ce sera favorable au business as usual: « Mes associés et moi avons dû expliquer longuement que KissKissBankBank ne représentait pas un manque à gagner pour l’industrie musicale, mais que, au contraire, cet outil permettait aux artistes d’établir une relation plus intéressante et renouvelée avec leur fans. Par ailleurs, notre plateforme permet de financer des projets spéciaux, qui ne sont pas ceux que les labels ont l’habitude de produire ».(1) Cette précaution d’entrée en dit long sur la continuité dans laquelle s’inscrit le modèle du crowdfunding, et non dans une logique de rupture avec le modèle dominant. Aujourd’hui, l’entreprise a atteint plus de 133 millions de fonds, géré 25.000 projets et compte 2,6 millions de membres.

Même si les trois fondateurs « croient fermement que l’économie de pair à pair ou d’individu à individu permet l’émergence de nouveaux modes d’organisation au sein de notre société », cela ne les empêchera pas de vendre en juillet 2017 KissKissBankBank à la Banque postale, faisant de la plateforme une des leaders européennes du financement participatif. Combien les tourtereaux du financement participatif ont-ils vendu leur boîte et sous quelles conditions, sachant qu’ils trônent toujours dans le comité de direction? « Le montant de la transaction n’a pas été communiqué, mais il devrait vraisemblablement graviter autour de la dizaine de millions d’euros, en sachant que la dernière levée de fonds de KKBB, en 2016, avait permis à la société de collecter 5,3 millions. Parmi les investisseurs présents lors de ce dernier tour de table, il y avait notamment Orange ».(2) L’entreprise devient rapidement l’un des principaux sites européens de financement participatif, et l’un des ses fondateurs, Adrien Aumont, rêve déjà d’un nouveau projet qui « séduit d’ores et déjà de grands noms de la finance ».(3)

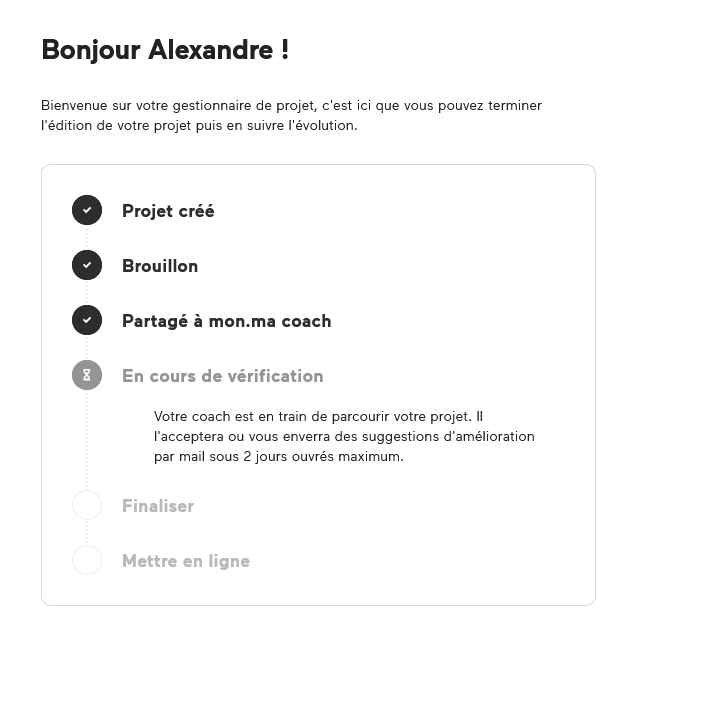

Le crowdfunding ne sort pas de la logique financière de la réduction des acteurs et on peut se demander si cette concentration dans quelques grosses boites ne va pas à l’encontre des principes de base d’un financement citoyen, en les mettant en position de choisir des projets bankables et acceptables pour le système en place. Si à l’origine, on pouvait penser que ces entrepreneurs modernes les laissaient exempts de toute censure et sélections des projets non pas seulement en fonction de leur probabilité de succès mais de leur acceptabilité politique, il n’en est rien. Derrière leur « responsabilité et éthique », fourre-tout que l’on trouve aussi bien sur le site de Total que dans un discours du parti Ecolo, ils s’octroient le droit d’une vérification par un « coach », qui se réserve le droit d’accepter le projet ou d’envoyer des suggestions d’amélioration sous 2 jours ouvrés maximum.

Et on a fait le test.

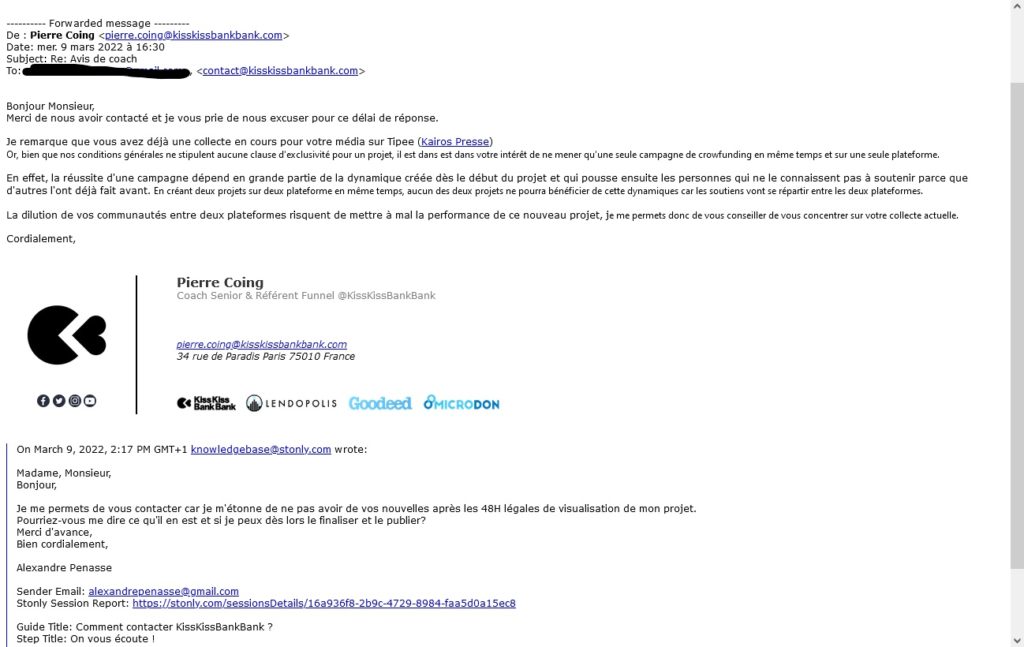

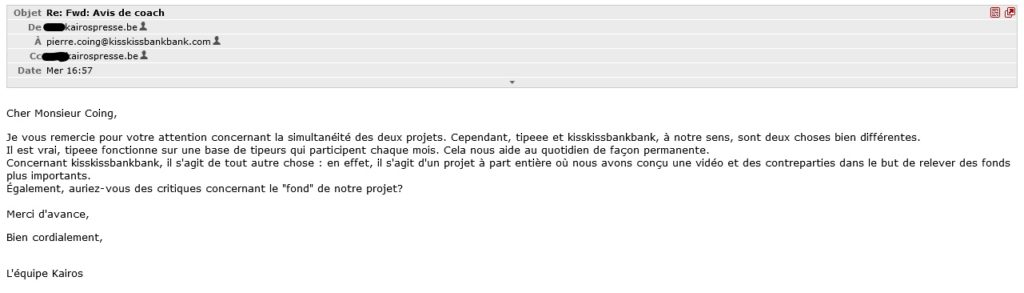

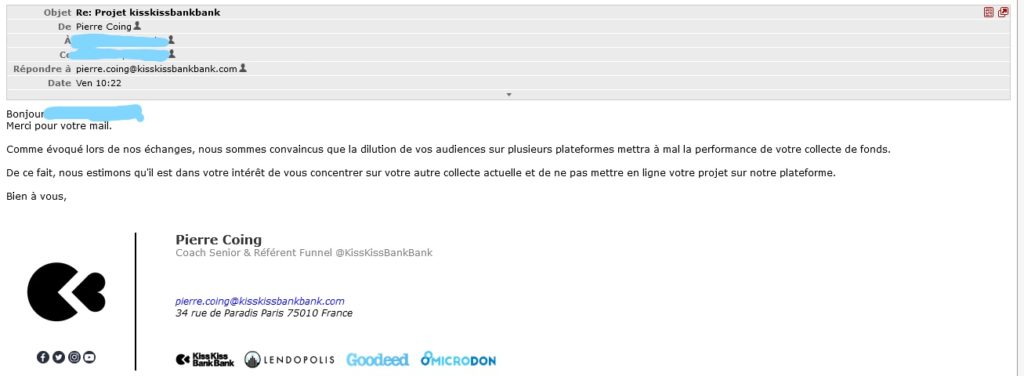

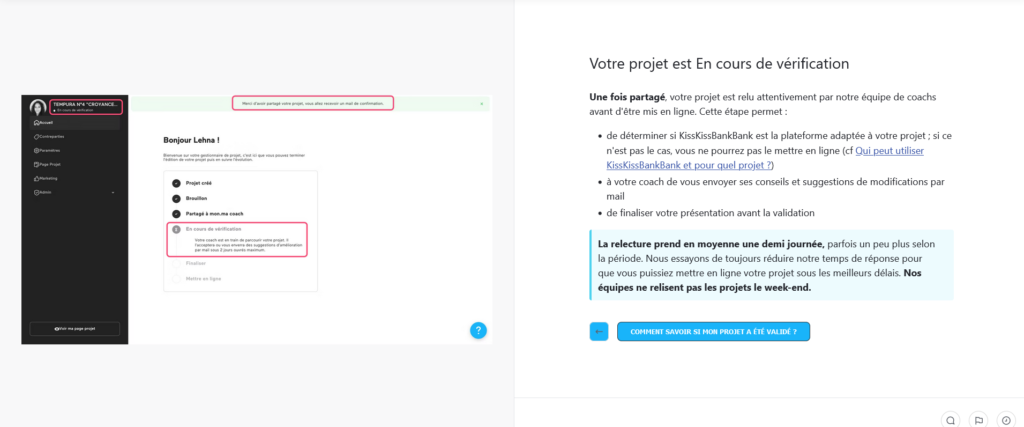

Nous avons soumis notre projet le vendredi 4 mars et avons eu une réponse seulement le mercredi 9 mars à 16h30 (soit hors-délai), après que nous ayons envoyé un message via le formulaire de contact. Voyez plutôt:

Nous avons gentiment expliqué au « coach » que nous n’avions pas « créé deux projets sur deux plateformes en même temps »:

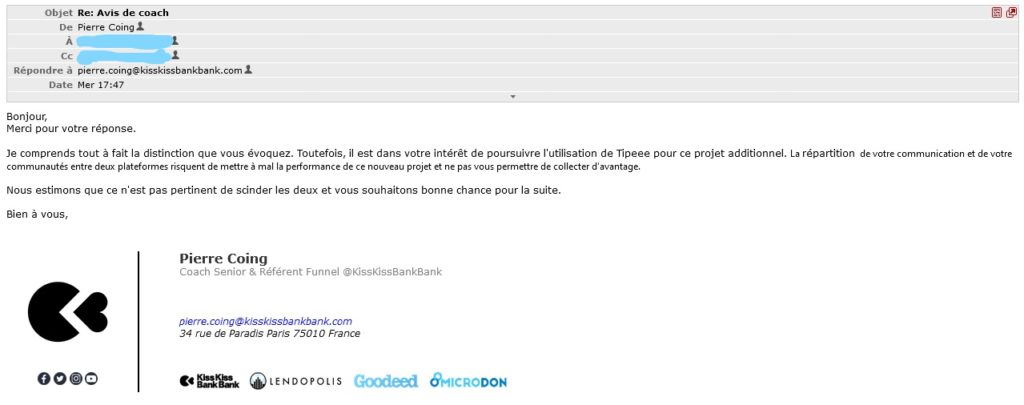

Le « coach » a « compris », mais pas vraiment…

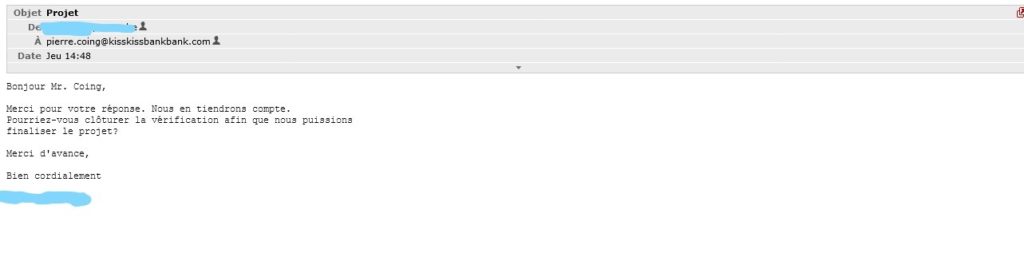

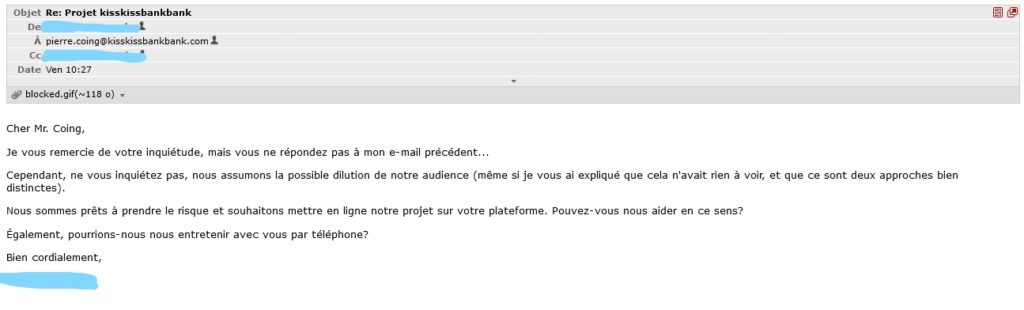

Après ces tergiversations, le couperet tombe :

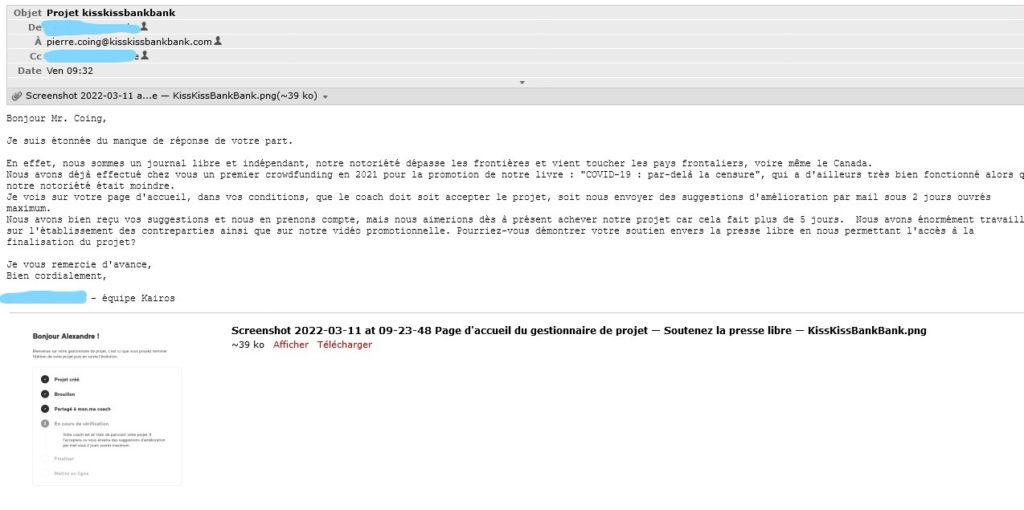

Et on lui a dit ce que l’on en pensait.

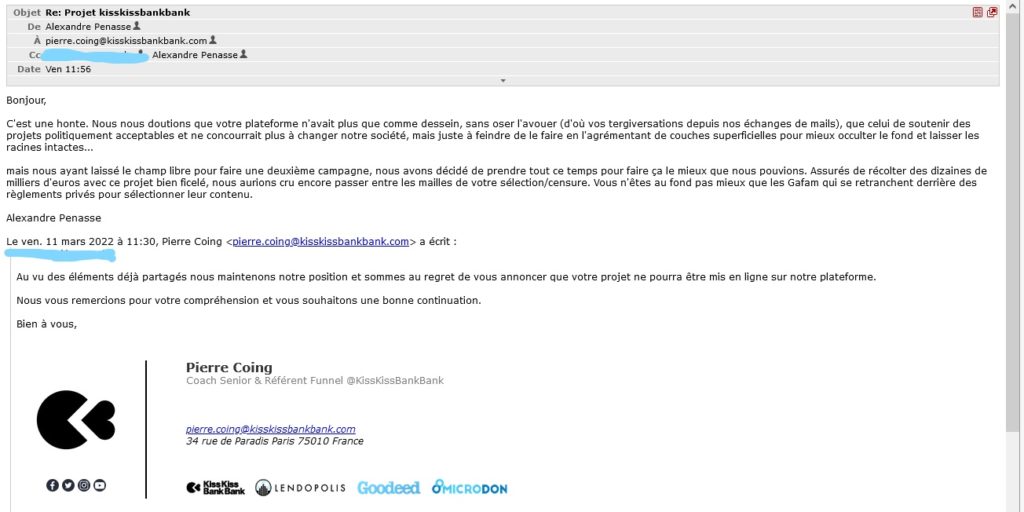

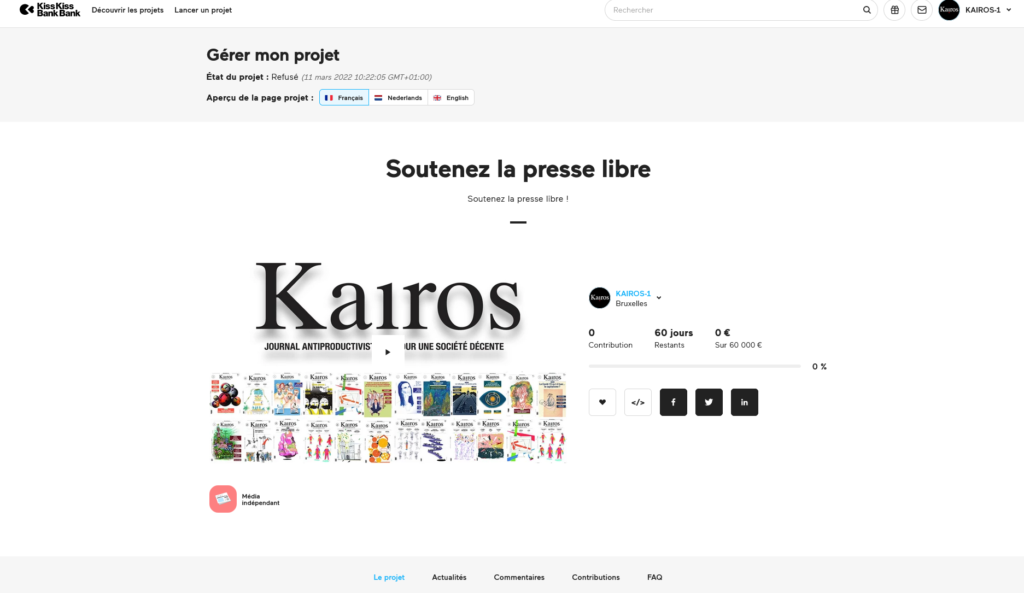

Cela nous vaudra donc le refus de notre projet :

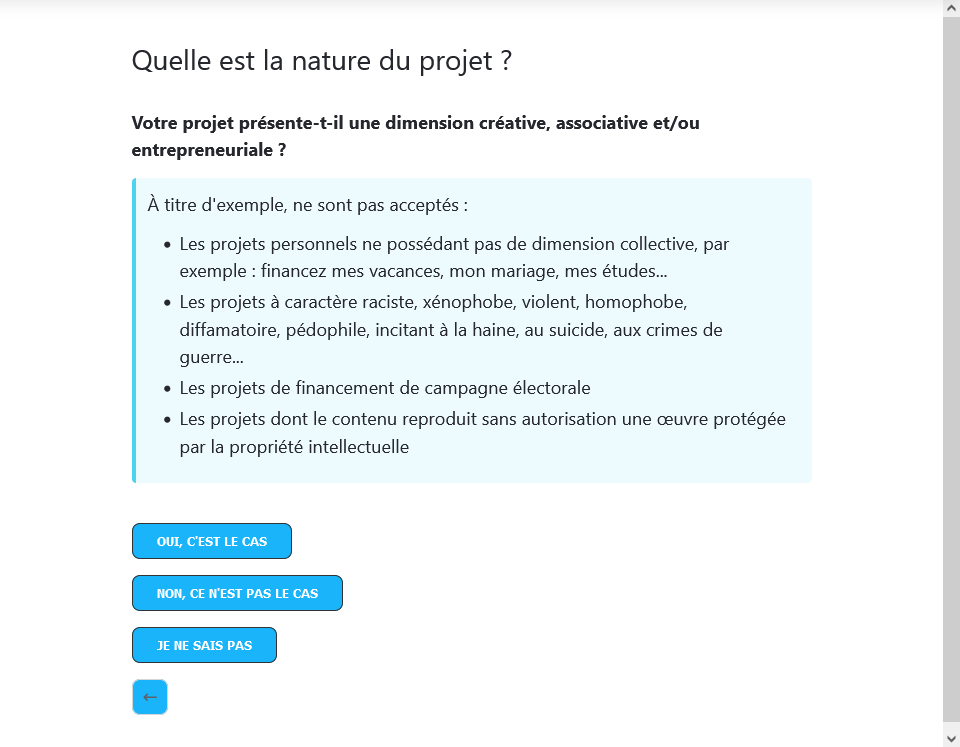

Pourtant, les étapes explicatives ne semblent même pas aborder la possibilité d’un refus:

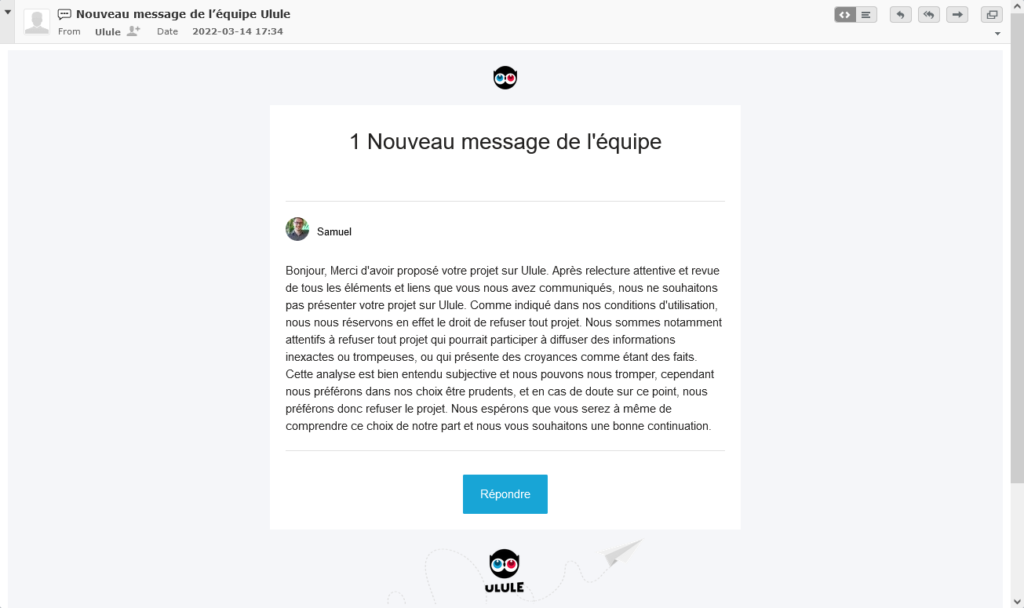

On a décidé de solliciter une autre plateforme, Ulule, qui a choisit de jouer dans la même cour, quoiqu’un peu plus franc, et la chouette a dit tout haut ce que KissKiss pensait tout bas. Le plus étonnant, c’est que nous ayons reçu le message de refus à peine 1 heure et demi après la soumission de notre projet, alors que nos contreparties et introductions se trouvaient encore à l’état d’ébauche. Pourtant, ils ont jugé que cela suffisait pour refuser le projet, prétextant que l’on « pourrait participer à diffuser des informations inexactes ou trompeuses, ou présenter des croyances comme étant des faits ». Surprenante cette efficacité d’Ulule à détecter les informations « inexactes ou trompeuses ». Mon petit doigt me dit qu’il s’agit plutôt de délit — non pas de faciès — mais de nom. Kairos serait-il devenu le loup blanc et la cible à abattre…

Le nouveau capitalisme, sous couvert de faire quelque chose d’autre, a juste exploité de nouvelles parts de marché et fait perdre encore un peu plus d’autonomie aux gens. A l’instar de YouTube ou Facebook qui privatisent la parole publique, les plateformes financières de crowdfunding ont privatisé un financement participatif qui n’aurait jamais dû sortir du domaine de la gestion collective.

- https://www.businessofeminin.com/ombline-le-lasseur/

- https://www.societe.com/actualites/adrien_aumont_l_entrepreneur_tous_terrains_qui_passe_de_la_finance_au_rail-54684.html

- https://www.huffingtonpost.fr/author/vincent-ricordeau

- https://www.nextinpact.com/article/26764/104681-la-banque-postale-rachete-100-kisskissbankbank